SETF offers financial services to nearly 700,000 retail and lease customers across Southeast Toyota's 177 dealers in Alabama, Florida, Georgia, North Carolina, and South Carolina.

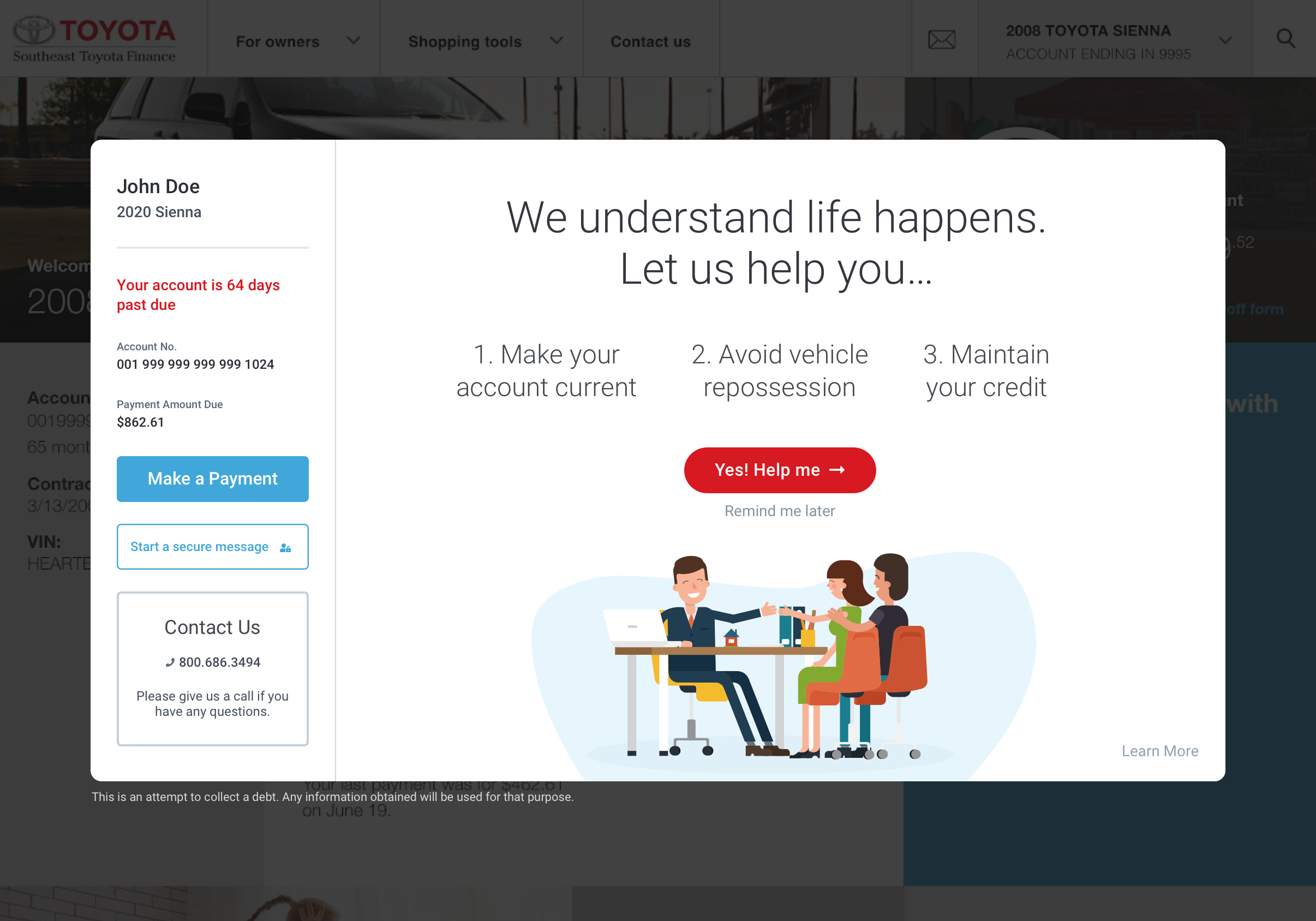

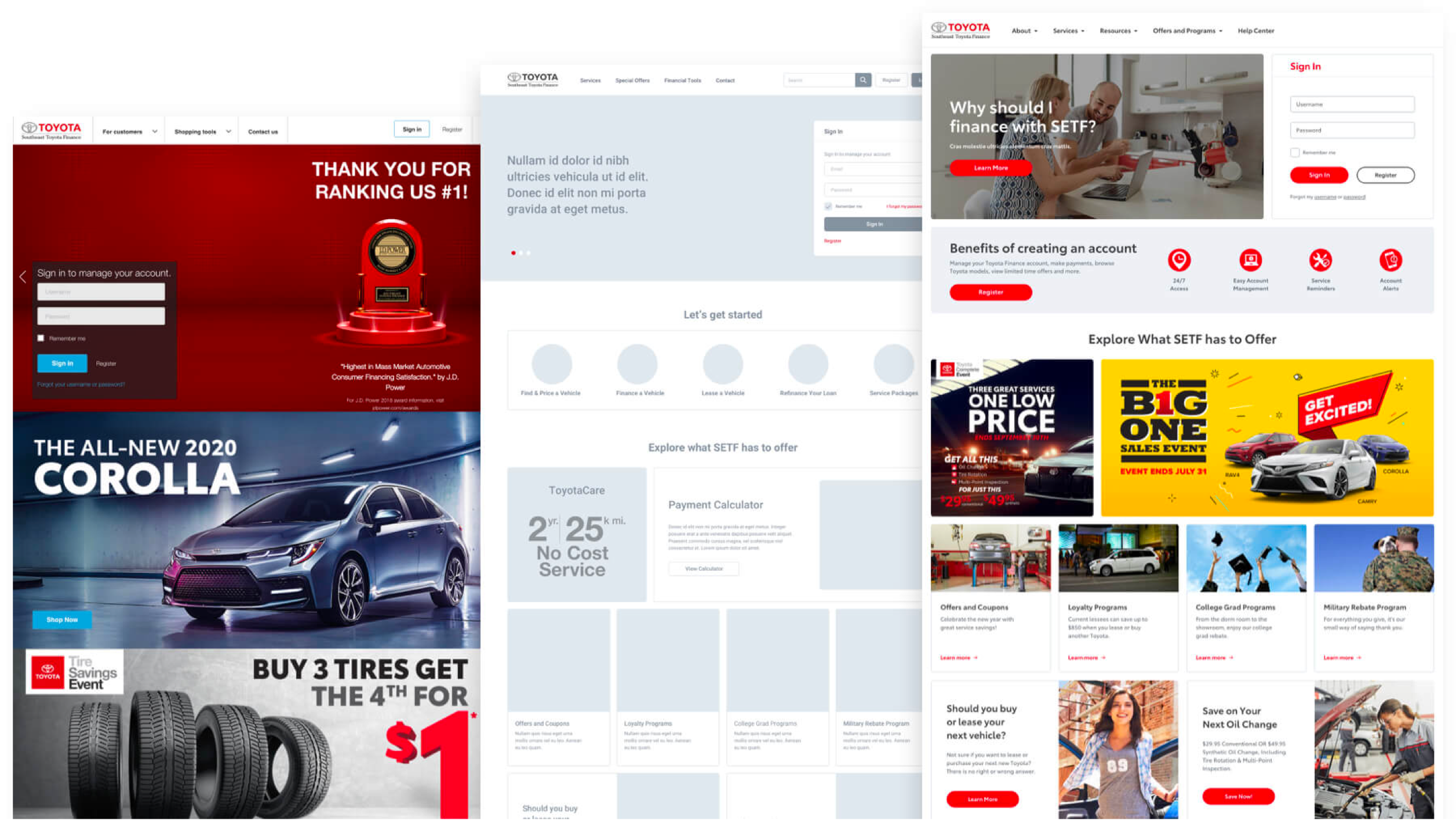

Its website, SETF.com, is intended for registered customers to manage their accounts and vehicles, make payments, explore offers and coupons, and get help.

Challenge

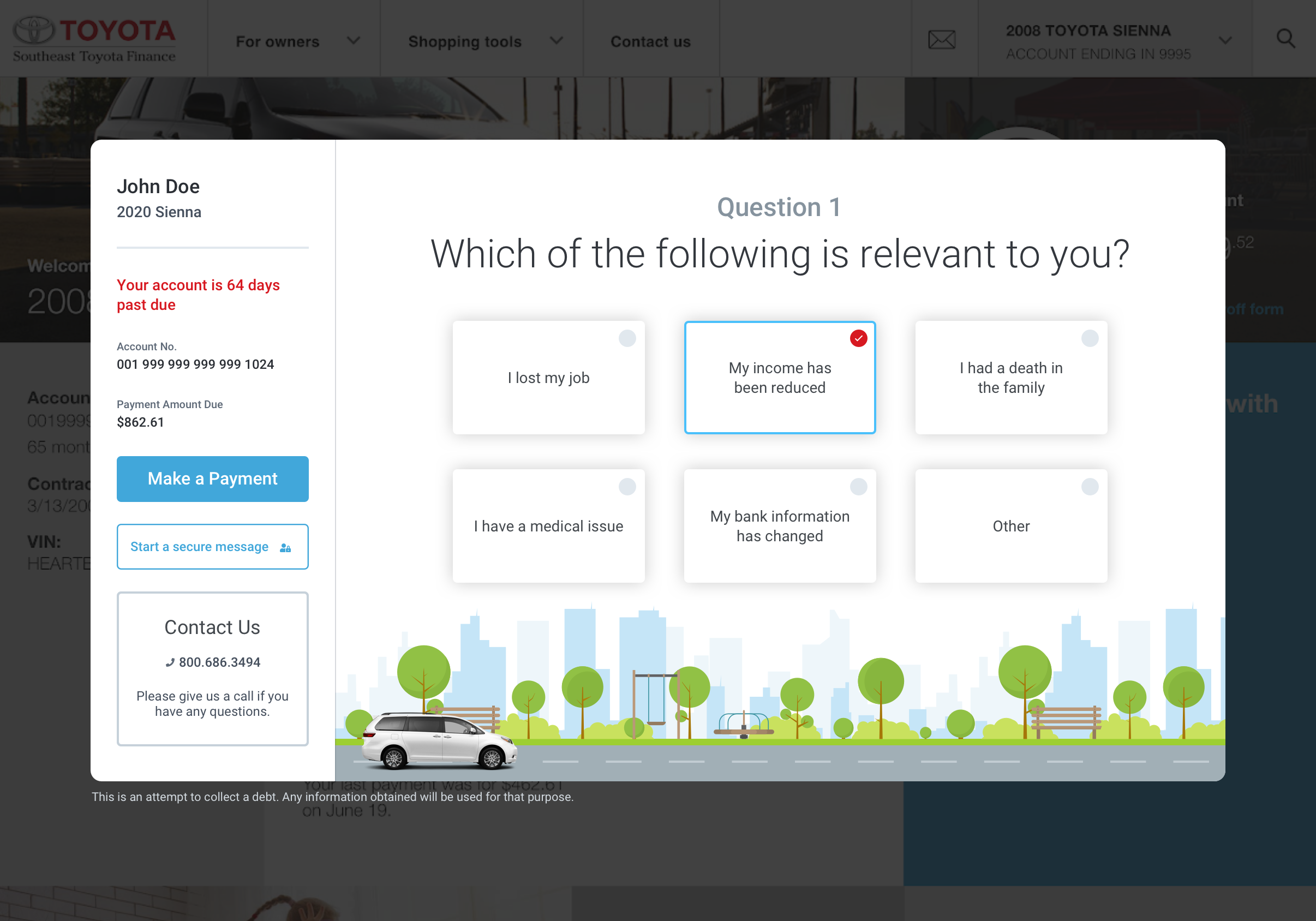

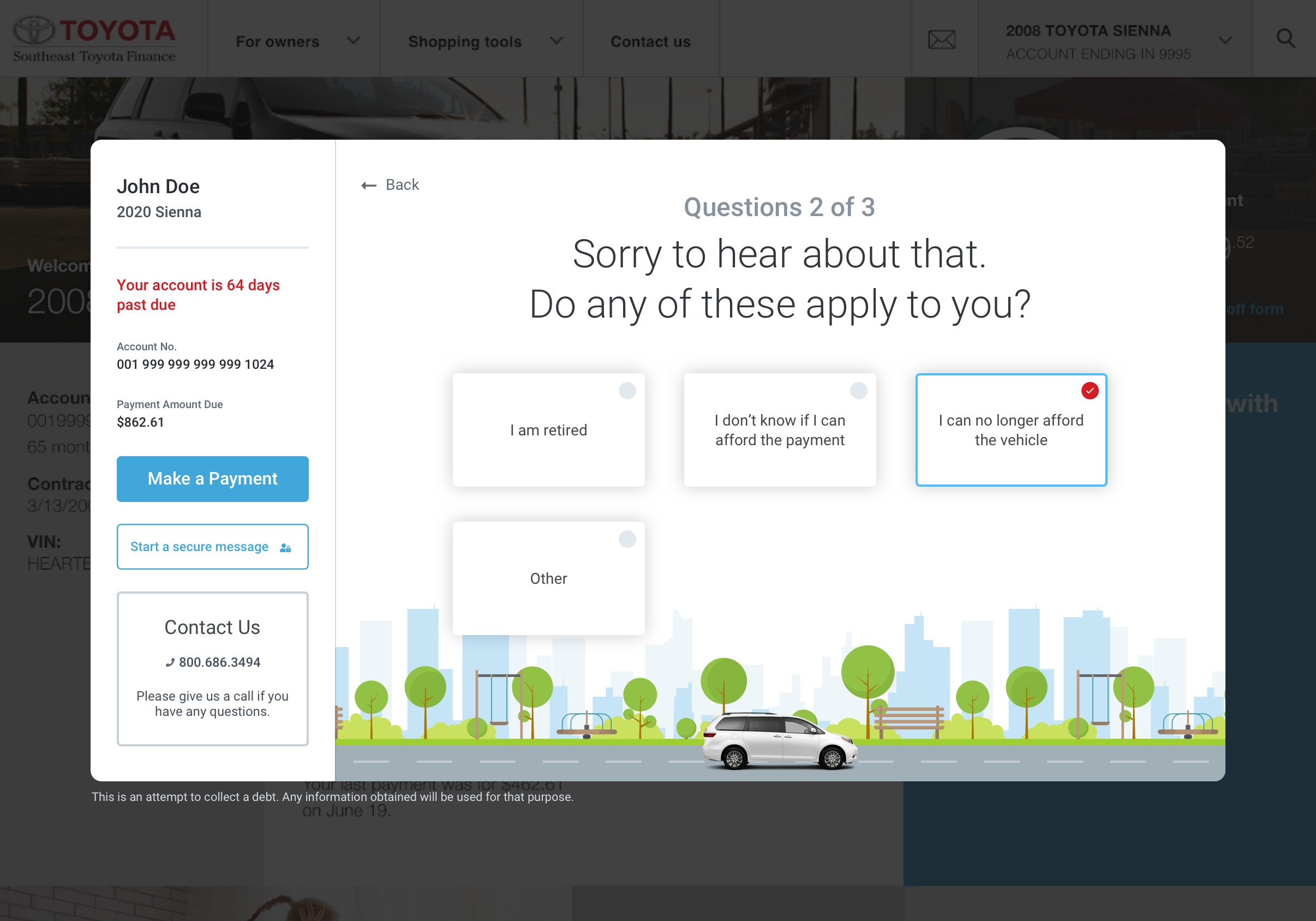

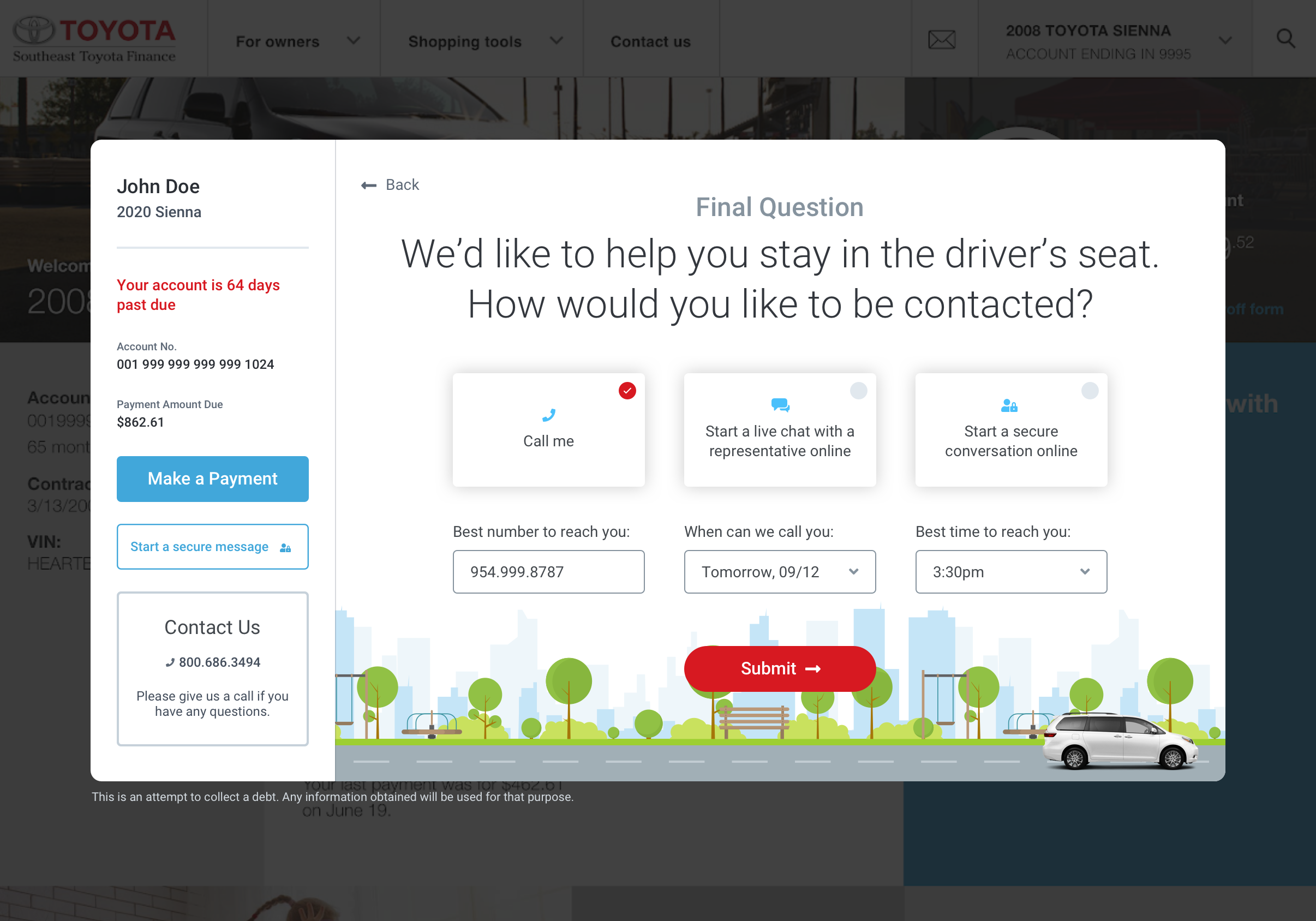

Unfortunately, some of their customers experience financial hardship and fall behind on their required monthly paments which can lead into collections.

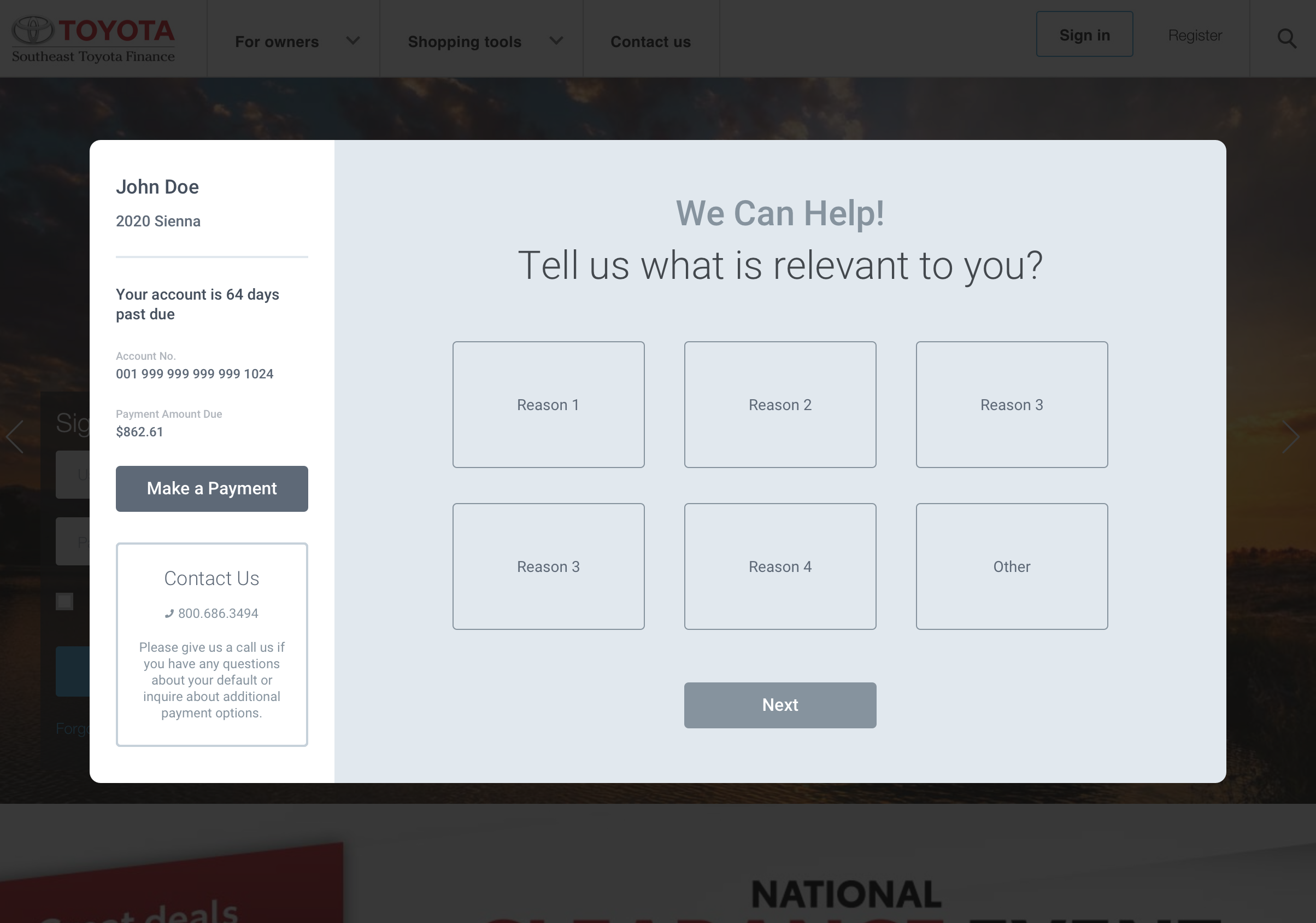

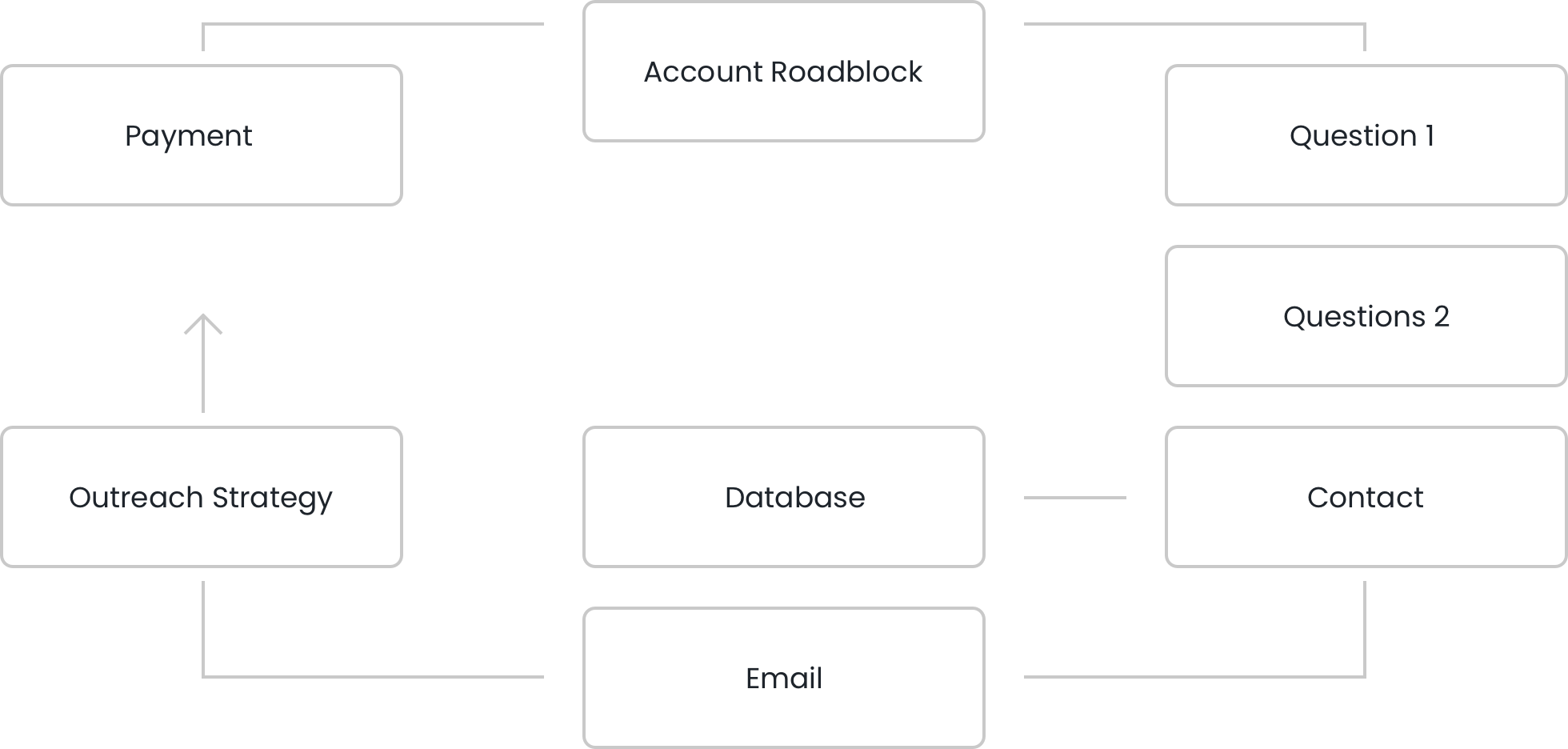

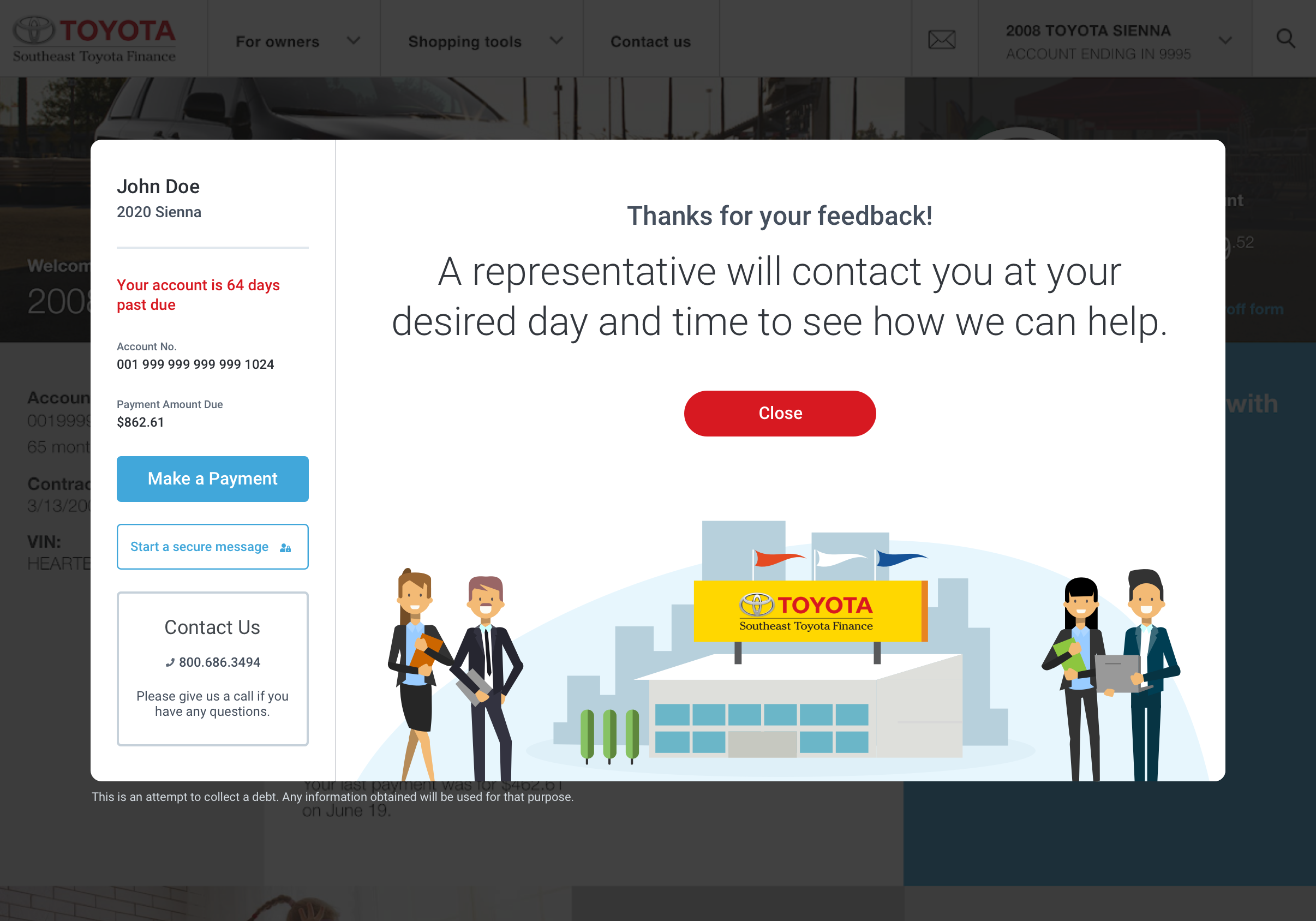

They needed to address their challenge by revamping how they interact with their customers in collections through a personalized engagment strategy that will reduce the number of past due accounts.